The W-4 form is a crucial document for both employers and employees in the United States. It is used to determine the amount of federal income tax that must be withheld from an employee’s paycheck. The form has undergone some changes in recent years, and it is important for professionals to stay updated on the latest version and understand how to fill it out correctly.

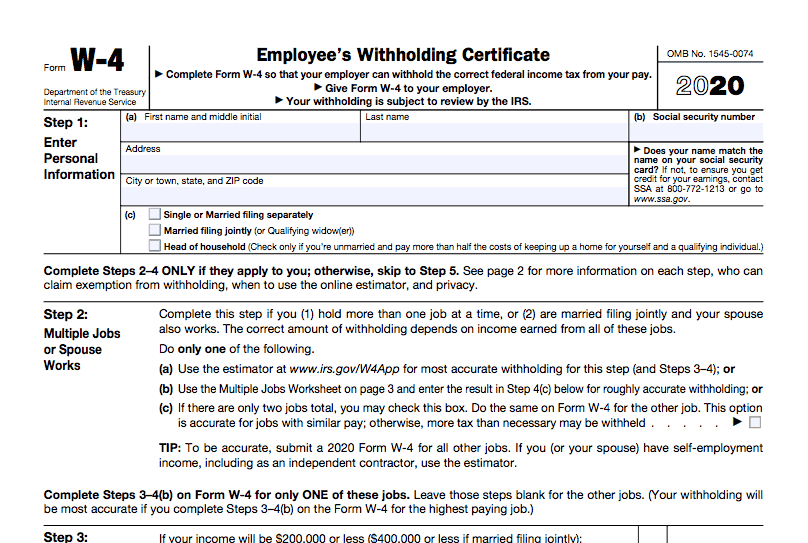

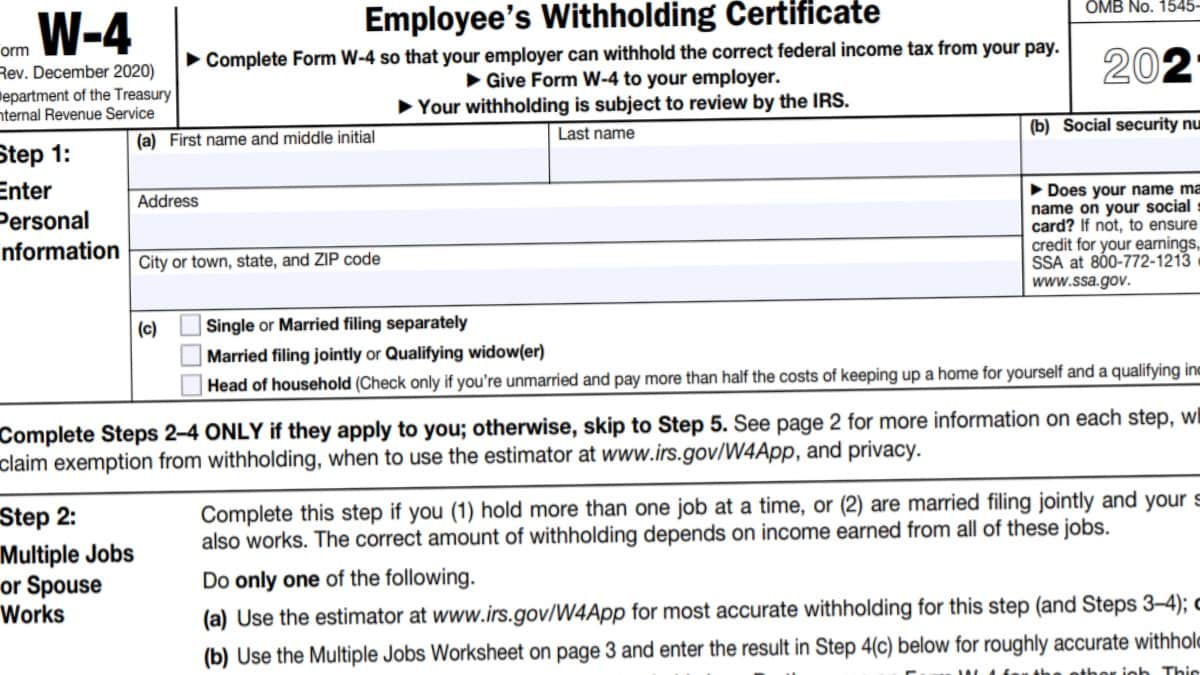

2020 Federal W-4 Form

The 2020 Federal W-4 Form, also known as the Employee’s Withholding Certificate, has been updated to better align with the Tax Cuts and Jobs Act of 2017. This form requires employees to provide information about their filing status, dependents, and other relevant details that affect their income tax withholding.

The 2020 Federal W-4 Form, also known as the Employee’s Withholding Certificate, has been updated to better align with the Tax Cuts and Jobs Act of 2017. This form requires employees to provide information about their filing status, dependents, and other relevant details that affect their income tax withholding.

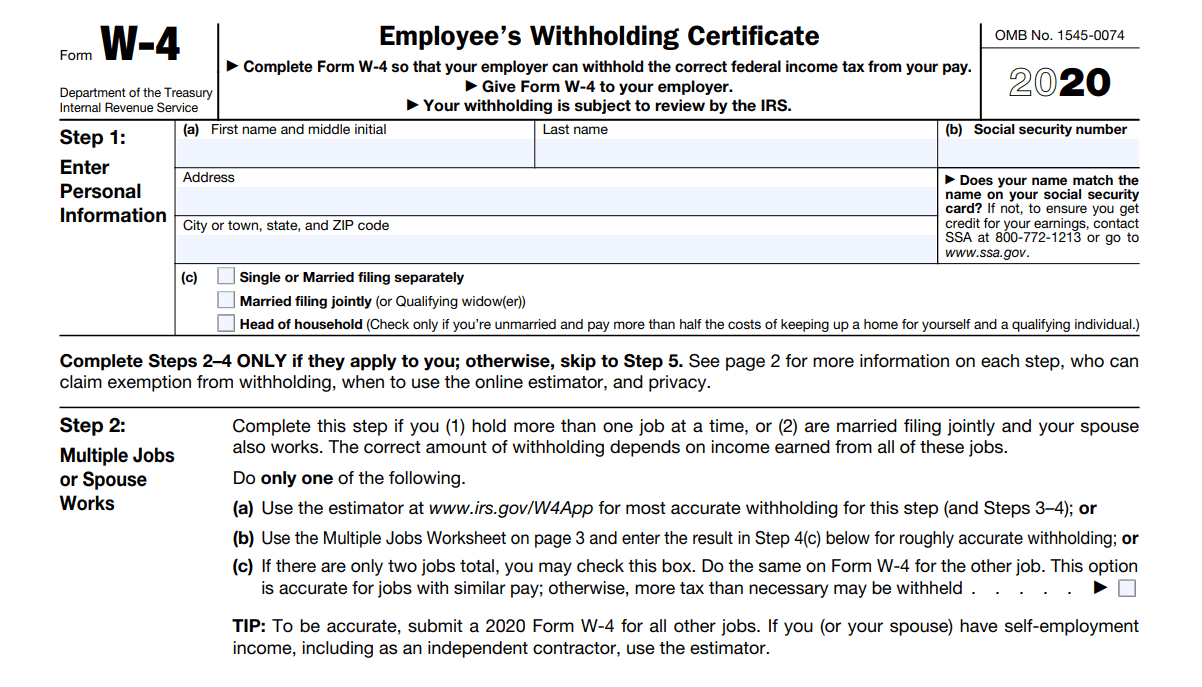

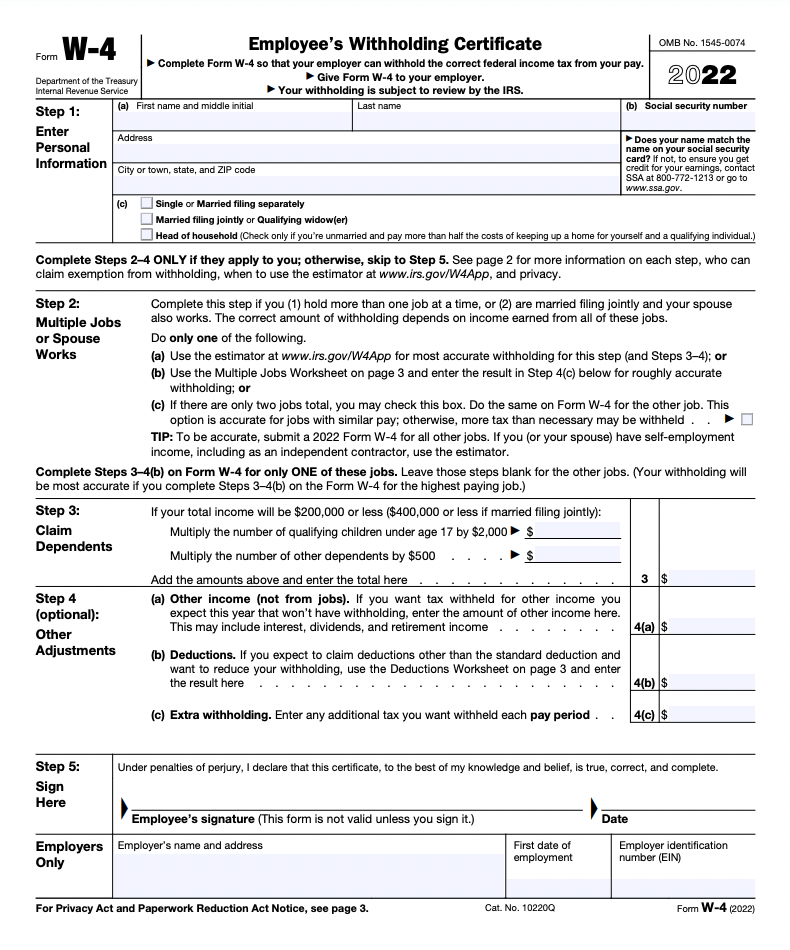

IRS Form W-4 2022

The IRS Form W-4 for the year 2022 is an essential tool for employees to ensure accurate tax withholding. This form provides instructions on how to complete it accurately and effectively manage tax deductions. It is important for professionals to familiarize themselves with this form to avoid any potential tax-related issues.

The IRS Form W-4 for the year 2022 is an essential tool for employees to ensure accurate tax withholding. This form provides instructions on how to complete it accurately and effectively manage tax deductions. It is important for professionals to familiarize themselves with this form to avoid any potential tax-related issues.

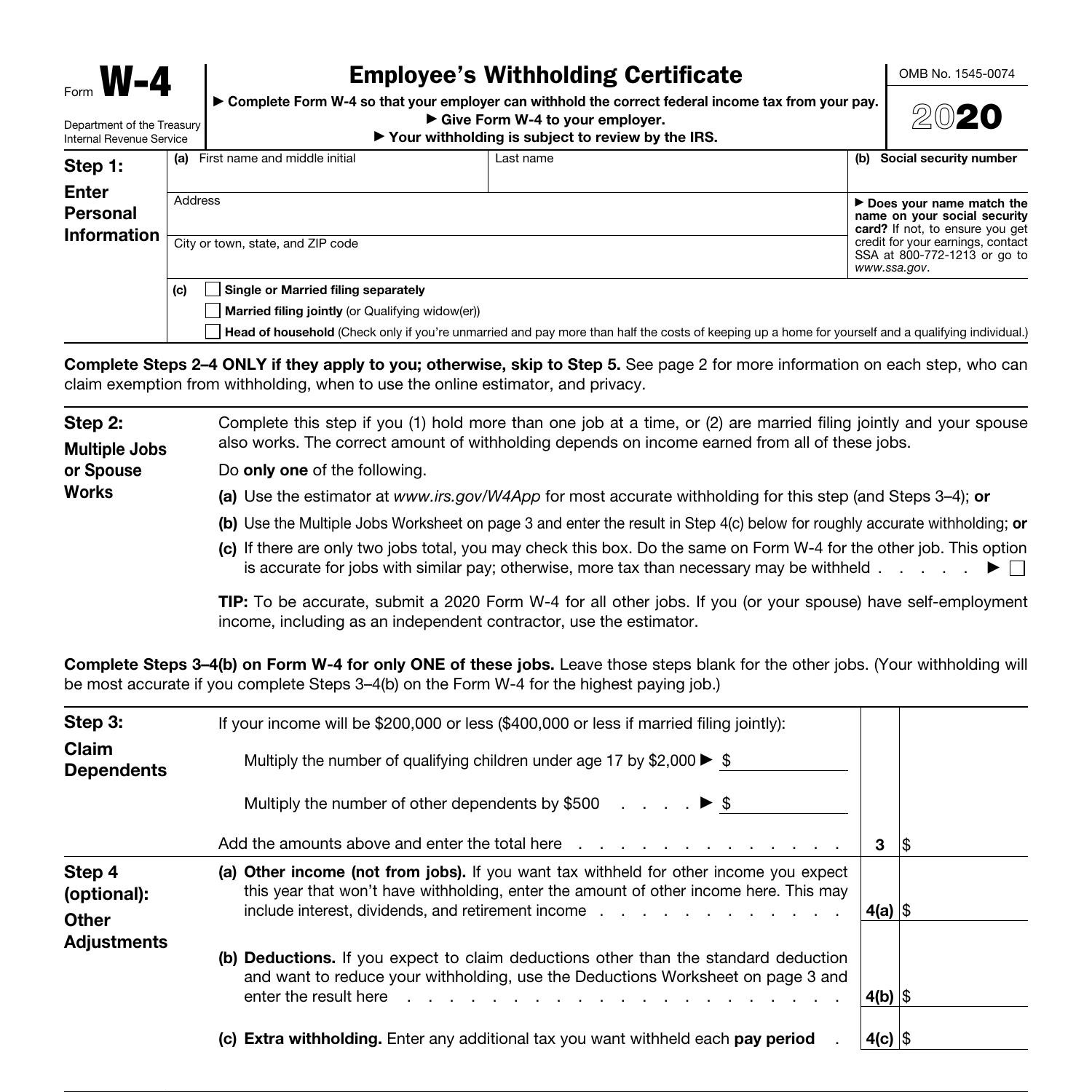

Printable 2020 W-4 Form

Having a printable 2020 W-4 form can be advantageous for professionals who prefer having a hard copy of the form. This allows for easier access and completion at any time. It is essential to keep track of any updates or revisions made to the form to ensure compliance with current tax regulations.

Having a printable 2020 W-4 form can be advantageous for professionals who prefer having a hard copy of the form. This allows for easier access and completion at any time. It is essential to keep track of any updates or revisions made to the form to ensure compliance with current tax regulations.

Form W-4 2020.pdf

Form W-4 2020.pdf is a digital version of the W-4 form that professionals can access online. This can be convenient for those who prefer submitting forms electronically or want to store a digital copy for easy retrieval. However, it is crucial to verify the authenticity and validity of the source to ensure the accuracy and security of personal information.

Form W-4 2020.pdf is a digital version of the W-4 form that professionals can access online. This can be convenient for those who prefer submitting forms electronically or want to store a digital copy for easy retrieval. However, it is crucial to verify the authenticity and validity of the source to ensure the accuracy and security of personal information.

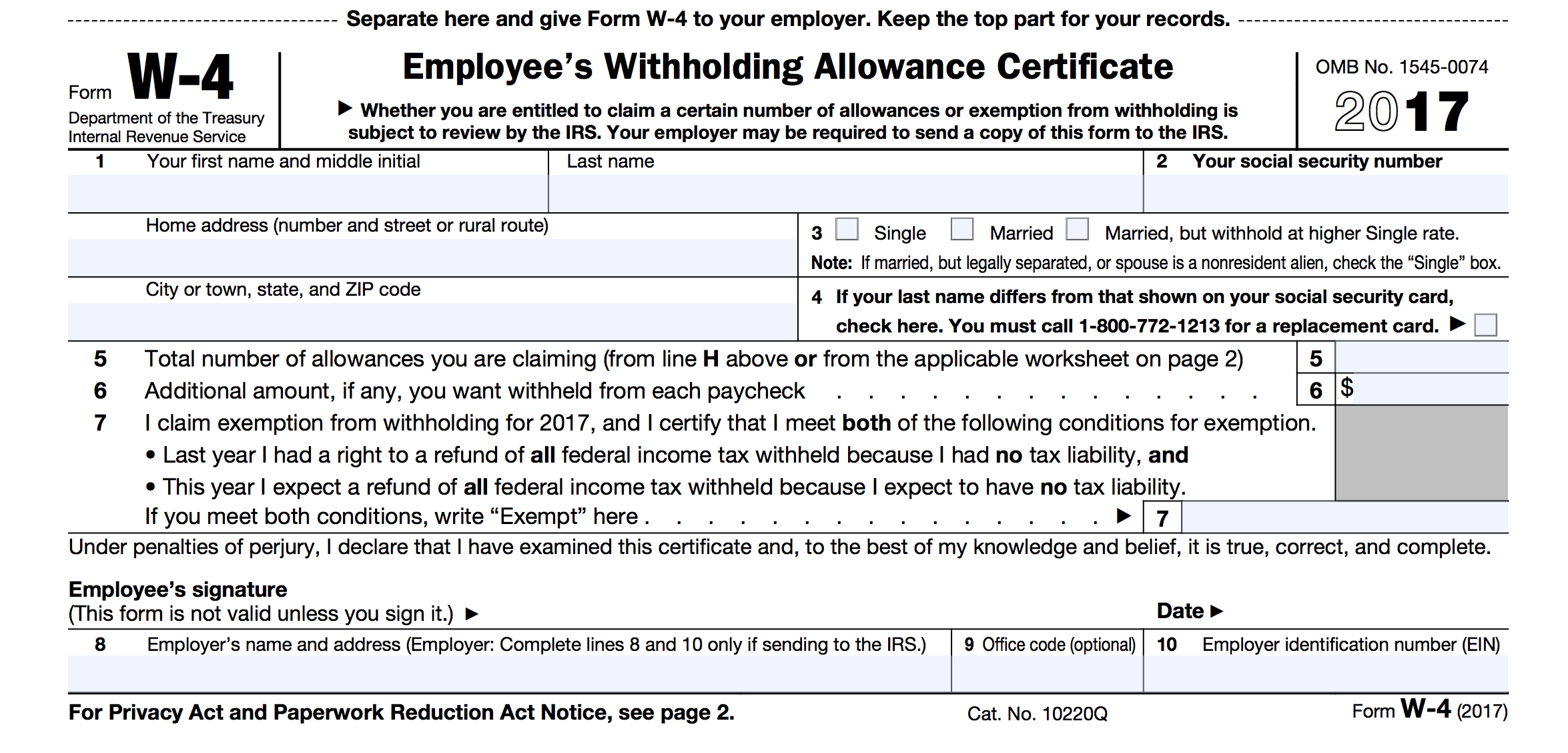

Printable W-4 and I-9 Forms

Understanding the W-4 and I-9 forms is essential for employers and employees alike. The W-4 form determines the federal income tax withholding, while the I-9 form verifies an employee’s eligibility to work in the United States. Professionals should ensure they have the correct versions of these forms and complete them accurately to avoid any legal or compliance issues.

Understanding the W-4 and I-9 forms is essential for employers and employees alike. The W-4 form determines the federal income tax withholding, while the I-9 form verifies an employee’s eligibility to work in the United States. Professionals should ensure they have the correct versions of these forms and complete them accurately to avoid any legal or compliance issues.

What Is Form W-4 and How to Fill It In 2022?

Form W-4 is a vital document that employees need to complete when starting a new job or when they want to adjust their tax withholding amount. It is crucial for professionals to understand the purpose and requirements of this form to ensure accurate and appropriate tax withholding. Filling out the form correctly can help prevent over or underpayment of taxes.

Form W-4 is a vital document that employees need to complete when starting a new job or when they want to adjust their tax withholding amount. It is crucial for professionals to understand the purpose and requirements of this form to ensure accurate and appropriate tax withholding. Filling out the form correctly can help prevent over or underpayment of taxes.

Blank I-9 and W-4 2020

Having access to a blank I-9 and W-4 2020 form can be helpful for employers who need to provide these forms to new hires. These forms need to be completed accurately and within the required timeframes to ensure compliance with employment and tax regulations. Professionals should keep copies of these blank forms on hand to streamline the onboarding process.

Having access to a blank I-9 and W-4 2020 form can be helpful for employers who need to provide these forms to new hires. These forms need to be completed accurately and within the required timeframes to ensure compliance with employment and tax regulations. Professionals should keep copies of these blank forms on hand to streamline the onboarding process.

Fillable 2021 W-4

A fillable 2021 W-4 form allows employees to complete the form electronically, saving time and effort. Professionals should use reputable and secure platforms when filling out and submitting digital forms to ensure the confidentiality of sensitive information. It is important to follow the instructions provided and to review the completed form before submission.

A fillable 2021 W-4 form allows employees to complete the form electronically, saving time and effort. Professionals should use reputable and secure platforms when filling out and submitting digital forms to ensure the confidentiality of sensitive information. It is important to follow the instructions provided and to review the completed form before submission.

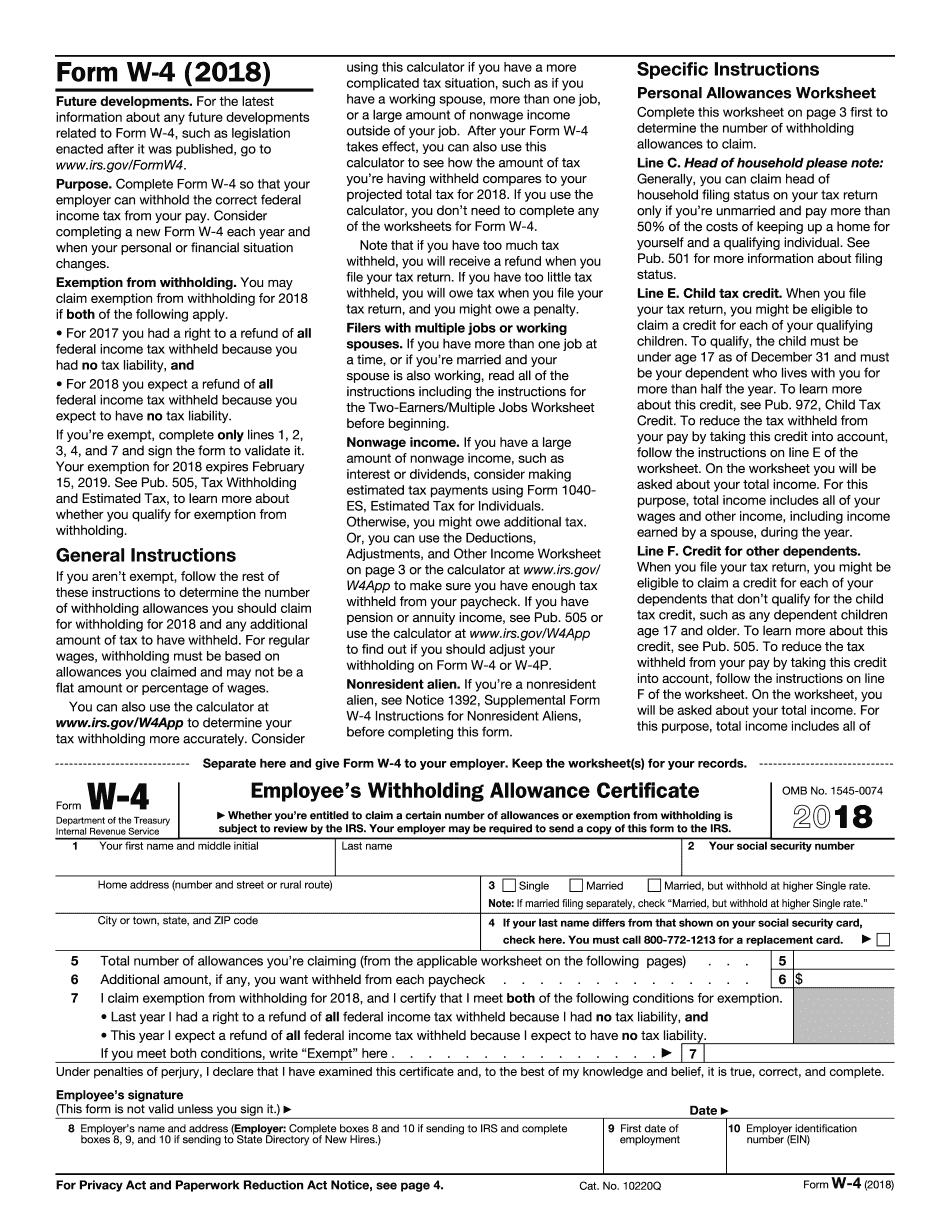

W-4 Form 2020

The 2020 W-4 form is an important document that employers and employees need to be familiar with. Understanding this form’s requirements and updates is crucial for accurate tax withholding. Employers should provide clear instructions to employees on how to complete this form, and employees should seek clarification if they have any questions or concerns.

The 2020 W-4 form is an important document that employers and employees need to be familiar with. Understanding this form’s requirements and updates is crucial for accurate tax withholding. Employers should provide clear instructions to employees on how to complete this form, and employees should seek clarification if they have any questions or concerns.

W-4 Forms 2020 Printable Pdf

Having access to a printable PDF version of the W-4 forms for the year 2020 can be beneficial for professionals who prefer a physical copy. This allows for easy reference and completion when needed. However, it is important to ensure the accuracy and validity of the form and to stay updated on any revisions or updates to tax regulations.

Having access to a printable PDF version of the W-4 forms for the year 2020 can be beneficial for professionals who prefer a physical copy. This allows for easy reference and completion when needed. However, it is important to ensure the accuracy and validity of the form and to stay updated on any revisions or updates to tax regulations.

In conclusion, understanding and correctly completing the W-4 form is crucial for both employers and employees. Professionals should familiarize themselves with the latest version of the form and stay updated on any changes in tax regulations. By accurately completing the form, individuals can ensure appropriate federal income tax withholding and avoid any potential issues or penalties related to tax compliance.